TTMS Net Banking: Login, Register & Transfer Funds

Digital banking is the need of the hour in the modern, fast paced world. People no longer have to bear waiting in long lines only to transfer money or check balances. TTMS net banking is short, fast, and safe to bank. You no longer need to visit the bank for everyday tasks. Whether it’s paying bills, sending money, managing deposits, or checking transactions, you can now do it all from home or office.

TTMS is designed for people who want convenience and safety together. You can access your account anytime, whether early morning or late at night. It’s perfect for people with busy schedules, business owners, salaried employees, or anyone who values time. It eliminates hours of bank-visiting work that was needed previously. And with TTMS, you can conduct banking in a few taps on your computer or phone. TTMS e banking is absolutely secured with strong PIN, OTP alongside real time alerts, which means your money and information is protected.

TTMS e banking is the most affordable and easiest way to manage the money. Have more in-depth information regarding this incredible service and how you can access it without a hassle.

What is TTMS Net Banking?

Tirumalla Tirupati Multistate Co-Operative Credit Society Limited TTMS net banking is a portal. It also aids customers in managing their accounts without going to a branch. You make transfers, bill payments, create deposits and check transactions at any time. TTMS runs on both mobile and computer. It is secure, easy, and available 24/7 for everyone.

Why Use TTMS Net Banking?

TTMS net banking is the fastest way to handle your finances. You don’t have to go to the bank anymore. You can check your balance, transfer funds, or pay utility bills from home. It gives you control over your account. You get instant updates and alerts. It makes life easier, especially for busy people and businesses.

Benefits of TTMS Net Banking

TTMS offers many benefits that make banking smooth. Here are the main advantages of using this service:

| Benefits | Details |

| 24/7 Banking | Access anytime, from anywhere |

| Safe and Secure | Strong PIN and OTP protection |

| Quick Transactions | Send money fast without delays |

| Bill Payments | Pay all types of bills online |

| Deposit Management | Open or close fixed and recurring deposits |

| Card Requests | Apply for cheque books and debit cards easily |

| Instant Alerts | Get notified for every action in real-time |

Key Features of TTMS Net Banking

With TTMS e banking, you can perform many tasks without visiting the bank. Here are its major features:

| Features | Details |

| Fund Transfers | NEFT, IMPS, RTGS, UPI |

| Bill Payments | Pay electricity, credit card, and water bills |

| Account Statements | View and download transaction records |

| Manage Deposits | Open/close fixed and recurring deposits |

| Service Requests | Order new cheque books and debit cards |

| Mobile Recharge | Recharge phone or DTH easily |

| Security Alerts | Real-time SMS and email notifications |

Register for TTMS Net Banking

Here are easy steps to register for TTMS e banking:

- Visit TTMS official website.

- Click on ‘New Member?’ option.

- Fill in details like access number, reference number, mobile, and date of birth.

- Create MPIN and Transaction PIN.

- Click ‘Get OTP’ and enter OTP received on your mobile.

- Enter security code and click ‘Send’.

Now you can start using TTMS e banking anytime.

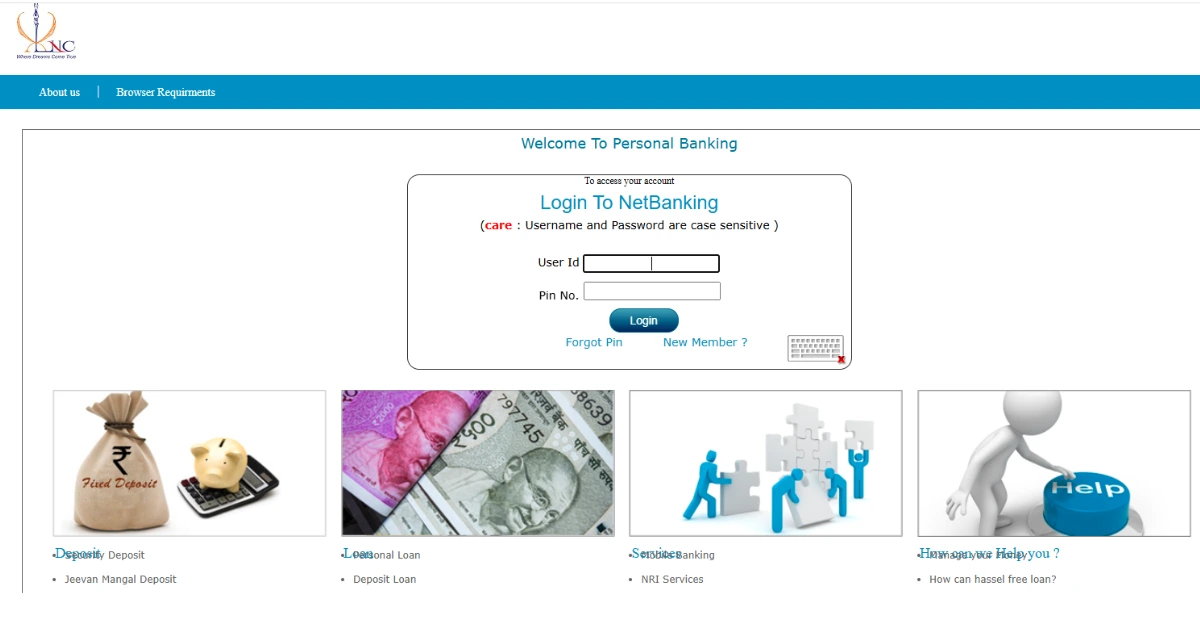

TTMS Net Banking: How to Login?

Login to TTMS e banking is very easy:

- Visit TTMS net banking login page.

- Enter your User ID and PIN.

- Click ‘Login’.

- Enter OTP sent to your mobile number.

- Click ‘Login’ again to access your account.

How to Reset TTMS Net Banking Password?

If you forget your login PIN, follow these steps:

- Go to the TTMS website.

- Click on ‘Forgot PIN’.

- Enter Access Number and Email ID.

- Click ‘Get OTP’ and enter OTP from mobile.

- Set a new login password.

How to Transfer Funds?

To transfer money using TTMS e banking, follow these steps:

- Login to TTMS net banking.

- Click ‘Fund Transfer’.

- Choose the transfer type (NEFT, IMPS, RTGS, UPI).

- Fill payee details (name, account number, IFSC).

- Enter amount and transaction PIN.

- Click ‘Submit’ to transfer.

How to Add a Beneficiary in TTMS Net Banking?

To add a payee, follow these steps:

- Login to TTMS net banking.

- Click ‘Fund Transfer’.

- Select ‘Beneficiary Maintenance’.

- Click ‘Create New Beneficiary’.

- Fill in details:

- Name

- Account number

- Email, mobile, and limits

- Click ‘Save Changes’.

Limits and Charges for Net Banking Transfers

| Transfer Type | Limits | Charges |

| NEFT | Based on bank policy | ₹2.5 + GST onwards |

| IMPS | Up to ₹5 lakh/day | ₹2.5 to ₹25 + GST |

| RTGS | Above ₹2 lakh | Charges depend on bank |

| Third-party Transfer | ₹10,000 to ₹50 lakh | As per limit set by customer |

Security Tips for TTMS e Banking

To stay safe while using TTMS e banking:

- Always use a strong and unique PIN.

- Never share your login details.

- Logout when done.

- Avoid public Wi-Fi for transactions.

- Update antivirus on your device.

- Do not click unknown links or emails.

Using TTMS Mobile Banking App

The TTMS Mobile Banking App is also available. Here’s how to use it:

- Download app from Play Store or App Store.

- Install and open the app.

- Enter Username and Password.

- Click ‘Login’ and access all services.

If you forget the password, click ‘Forgot Password’, enter OTP, and set a new password.

Conclusion

TTMS net banking is a simple and fast way to manage your money. You don’t need to visit a bank for small tasks anymore. You can check your balance, pay bills, and send money in minutes. All this can be done from home. TTMS net banking is secure with OTP and PIN protection. It works 24/7 for your convenience. Whether you are a business owner or an individual, TTMS helps you manage finances better. It is the modern way of banking. If you want to save time, stay secure, and have full control, start using net banking today. This service is here to make life easier, safer, and smarter.

FAQs

Q1: Can I apply for a debit card through TTMS?

Ans. Yes, use “Request Services” to apply.

Q2: Is TTMS safe?

Ans. Yes, it uses PIN and OTP for security.

Q3: What if I forget my User ID?

Ans. Contact TTMS customer care for help.

Q4: Can I check my account statement online?

Ans. Yes, download it anytime through TTMS net banking.

Q5: How much money can I transfer using TTMS?

Ans. You can transfer up to ₹5 lakh daily via IMPS and higher amounts via RTGS.

Read Our More Blogs..